To create a financial freedom plan that works, start by setting clear goals and creating a budget. Then, focus on saving and investing wisely, paying off debt, and diversifying your income streams.

By following these steps, you can develop a robust financial plan that will lead you towards achieving financial freedom. Creating a financial freedom plan is essential for anyone who wants to achieve long-term financial stability and independence. It involves setting clear goals, managing your finances effectively, and making strategic decisions to build wealth.

In this blog post, we will explore the key steps to creating a financial freedom plan that actually works. By following these guidelines, you can take control of your financial future, eliminate debt, and create a solid foundation for financial success. So, let’s dive in and discover how you can create a plan that will pave the way to financial freedom.

The Essence Of Financial Freedom

Discover the key to financial freedom with a personalized plan that actually works. Learn how to create a foolproof strategy to achieve your financial goals and live a life free from money-related stress.

Defining Financial Independence

Financial independence is a term that has gained significant popularity in recent years. It refers to the ability to live the life you desire without being constrained by financial limitations. When you are financially independent, you have the freedom to make choices based on your personal preferences rather than financial constraints. It is a state of financial security and peace of mind that allows you to pursue your passions, achieve your goals, and enjoy a fulfilling life.

Why Financial Freedom Matters

Financial freedom is not just about accumulating wealth; it is about having control over your financial situation and being able to make decisions that align with your values and aspirations. Here are a few reasons why financial freedom matters:

- Peace of mind: Achieving financial freedom provides a sense of security and peace of mind, knowing that you have a solid financial foundation and are prepared for any unexpected challenges that may arise.

- Flexibility and independence: Financial freedom allows you to have more flexibility and independence in your life. You can choose the career path you love, take time off to travel, start a business, or pursue your passions without the constant worry of financial obligations.

- Reduced stress: Financial stress can be a significant source of anxiety and strain on your overall well-being. By attaining financial freedom, you can significantly reduce stress levels and focus on living a more balanced and fulfilling life.

- Opportunities for growth: When you are financially free, you have the resources to invest in personal and professional growth. Whether it’s furthering your education, starting a new venture, or investing in assets, financial freedom opens up a world of opportunities for personal and financial growth.

- Generational impact: Achieving financial freedom not only benefits you but also has the potential to positively impact future generations. By creating a solid financial foundation, you can pass on valuable knowledge and resources to your loved ones, empowering them to pursue their own financial independence.

Financial freedom is a journey that requires careful planning, discipline, and perseverance. By understanding the essence of financial freedom and why it matters, you can take the necessary steps to create a financial freedom plan that works for you.

Credit: www.amazon.com

Setting Clear Financial Goals

Creating clear financial goals is crucial to achieving financial freedom. By setting achievable targets, creating a budget, and monitoring progress regularly, you can create a plan that works. With discipline and persistence, you can achieve your financial goals and enjoy the freedom that comes with financial stability.

Short-term Vs Long-term Objectives

Setting clear financial goals is essential for achieving financial freedom. When setting goals, consider short-term and long-term objectives. Short-term goals focus on immediate needs, while long-term goals look at the bigger picture.Smart Goal Framework

Utilize the SMART goal framework for setting clear financial objectives. Specific goals are well-defined, measurable goals are quantifiable, attainable goals are realistic, relevant goals align with your financial vision, and time-bound goals have a set deadline for achievement.Remember to regularly review and adjust your financial goals to stay on track towards achieving financial freedom.Assessing Your Current Financial Health

Before creating a financial freedom plan, it is essential to assess your current financial health. This will help you identify your financial strengths and weaknesses, and determine the steps you need to take to achieve financial freedom. Here are two important factors to consider when assessing your financial health:

Calculating Net Worth

Calculating your net worth is an essential step in assessing your financial health. Your net worth is the difference between your total assets and total liabilities. This gives you a clear picture of your financial standing at a specific point in time. Here is how to calculate your net worth:

| Assets | Liabilities |

|---|---|

| Home | Mortgage |

| Car | Auto Loan |

| Investments | Credit Card Debt |

| Savings Account | Personal Loan |

| Retirement Account | Student Loan |

Once you have listed all your assets and liabilities, subtract your total liabilities from your total assets. The resulting figure is your net worth. A positive net worth indicates that you have more assets than liabilities, while a negative net worth indicates that you have more liabilities than assets.

Understanding Cash Flow

Understanding your cash flow is another critical factor in assessing your financial health. Cash flow is the amount of money that comes in and goes out of your bank account each month. Understanding your cash flow will help you identify areas where you can cut back on expenses and increase your income. Here is how to calculate your cash flow:

- Add up your total monthly income

- Subtract your total monthly expenses

- The resulting figure is your cash flow

A positive cash flow indicates that you have more money coming in than going out, while a negative cash flow indicates that you are spending more than you are earning.

Assessing your current financial health is the first step towards creating a financial freedom plan. By calculating your net worth and understanding your cash flow, you can identify areas where you can improve your finances and take steps towards achieving financial freedom.

Creating A Budget That Aligns With Your Goals

Crafting a budget that mirrors your aspirations is crucial for establishing a successful financial freedom plan. By aligning your budget with your goals, you can pave the way for a secure and prosperous future. Start by outlining your objectives and tailoring your budget to achieve them effectively.

Budgeting Basics

Creating a budget that aligns with your goals is an essential step towards achieving financial freedom. By establishing a clear and realistic budget, you can gain better control over your finances and make informed decisions about your spending and saving habits. Budgeting involves carefully tracking your income and expenses, prioritizing your financial goals, and making necessary adjustments to ensure you stay on track. Let’s explore some budgeting basics to help you get started on your path to financial freedom.Tools And Apps To Keep Track

In today’s digital age, there are numerous tools and apps available to help you keep track of your budget. These tools can simplify the budgeting process and provide you with a comprehensive overview of your financial situation. Here are some popular tools and apps that can assist you in managing your budget effectively:1. Personal Finance Software: Software like Mint or YNAB (You Need A Budget) allows you to link your bank accounts, credit cards, and other financial accounts to track your income and expenses automatically. These tools provide visual representations of your budget and offer helpful features like bill reminders and goal tracking.2. Expense Tracking Apps: Apps such as PocketGuard or Expensify make it easy to record your expenses on the go. You can categorize your spending, set spending limits, and receive alerts when you approach or exceed your budgeted amount.3. Spreadsheets: If you prefer a more manual approach, using spreadsheet software like Microsoft Excel or Google Sheets can be an effective way to create and manage your budget. You can customize your spreadsheet to fit your specific needs and track your income, expenses, and savings goals.4. Envelope System: The envelope system is a traditional budgeting method where you allocate cash into labeled envelopes for different expense categories. This physical representation of your budget can help you visualize and control your spending.5. Automatic Savings Apps: Apps like Acorns or Digit can automatically save small amounts of money for you based on your spending patterns. These apps analyze your income and spending habits, rounding up purchases or transferring spare change into a savings account.Remember, the key to successful budgeting is finding the tool or app that works best for you. Experiment with different options until you find the one that fits your lifestyle and financial goals seamlessly. With the right tools in place, you can stay organized, make informed financial decisions, and ultimately achieve the financial freedom you desire.Eliminating Debt Strategically

When it comes to creating a solid financial freedom plan, eliminating debt strategically is a crucial step towards achieving lasting financial stability. By implementing effective debt reduction strategies, individuals can take control of their finances and work towards a debt-free future.

Debt Snowball Vs. Avalanche Method

One popular approach to eliminating debt strategically is to compare the debt snowball and avalanche methods. The debt snowball method involves paying off the smallest debts first, regardless of interest rates, to create a sense of accomplishment and motivation. On the other hand, the debt avalanche method focuses on tackling debts with the highest interest rates first, potentially saving money on interest payments in the long run.

Negotiating Lower Interest Rates

Another strategic way to eliminate debt is by negotiating lower interest rates with creditors. By demonstrating a commitment to repaying the debt, individuals may be able to secure reduced interest rates, ultimately lowering the overall amount owed and accelerating the debt payoff process.

Building An Emergency Fund

Building an Emergency Fund is a crucial component of any financial plan. It provides a safety net for unexpected expenses and helps prevent the need to dip into long-term savings or go into debt. By establishing an emergency fund, individuals can achieve greater financial security and peace of mind.

How Much To Save

Experts recommend saving at least three to six months of living expenses in an emergency fund. This amount can vary based on individual circumstances, such as job stability, health, and family situation. It’s essential to assess personal factors and create a savings goal that aligns with specific needs.

Best Practices For Emergency Savings

- Consistently set aside a portion of income for the emergency fund.

- Keep the funds in a separate, easily accessible account, such as a high-yield savings account.

- Reassess the savings goal periodically to adjust for changes in financial situation.

- Use the fund only for genuine emergencies, such as medical expenses or unexpected car repairs.

- Consider automating contributions to the emergency fund to ensure regular deposits.

Investing Wisely For The Future

Creating a solid financial freedom plan requires investing wisely for the future. Understanding different investment vehicles and implementing effective risk management strategies are crucial steps towards achieving long-term financial stability.

Understanding Investment Vehicles

- Diversify your portfolio across stocks, bonds, real estate, and other assets.

- Consider low-cost index funds for passive investing.

- Research and choose investments that align with your risk tolerance and financial goals.

Risk Management In Investing

- Set clear investment objectives and time horizons.

- Regularly review and adjust your portfolio based on market conditions.

- Utilize strategies like asset allocation and dollar-cost averaging to mitigate risks.

Diversifying Income Streams

Create a solid financial freedom plan by diversifying your income streams. By exploring different avenues of generating income, you can build a more resilient and sustainable financial future. Take control of your finances and open up opportunities for long-term wealth creation.

Benefits Of Multiple Income Sources

Diversifying income sources can provide financial stability.Having multiple income streams reduces financial risk.It helps in securing a consistent cash flow.Ideas For Passive Income

Real Estate: Rental properties can generate passive income.Investing in Stocks: Dividends offer a source of passive income.Online Business: Creating digital products for passive income.Peer-to-Peer Lending: Earn interest by lending money online.Affiliate Marketing: Promote products and earn commissions.Create an App: Develop an app for passive income generation.Continuous Learning And Financial Education

Empower yourself with continuous learning and financial education to secure your financial future.

Keeping Up With Financial News

Stay updated on the latest financial news to make informed decisions.

Educational Resources And Courses

Explore various educational resources and courses to enhance your financial knowledge.

Credit: www.instagram.com

Regular Review And Adjustment Of Your Plan

Ensure the effectiveness of your financial freedom plan by regularly reviewing and adjusting it. This practice allows for flexibility and optimization, increasing the plan’s chances of success. Regular review and adjustment are crucial for creating a financial freedom plan that truly works.

Scheduling Financial Check-ups

Regular review and adjustment of your financial plan is crucial for success.Adapting To Life Changes

Scheduling regular financial check-ups helps you adapt to life changes effectively.Benefits of Regular Review: – Ensures your plan aligns with current goals. – Identifies areas for improvement. – Enables you to make informed decisions. When to Schedule Check-ups: 1. Quarterly reviews for short-term adjustments. 2. Annual reviews for long-term planning. Life Changes to Consider: – Marriage or divorce. – Birth of a child. – Career changes. – Health issues. Adjusting Your Plan: – Update budget based on new circumstances. – Modify savings goals to reflect changes. Stay Proactive: – Be proactive in reviewing and adjusting your financial plan. Final Thoughts: – Regular reviews and adjustments are key to financial success.Staying Motivated And Overcoming Setbacks

Staying motivated and overcoming setbacks are essential aspects of creating a financial freedom plan that truly works. Coping with financial stress, celebrating milestones, and staying resilient in the face of challenges are key components of this journey.

Coping With Financial Stress

Financial stress can be overwhelming, but finding healthy ways to cope is crucial. Here are some strategies to help you navigate through challenging times:

- Practice mindfulness and meditation to reduce anxiety

- Engage in physical activities to alleviate stress

- Seek support from friends, family, or a financial advisor

Celebrating Milestones

Recognizing and celebrating milestones along the way can provide the motivation needed to continue pursuing financial freedom. Here are a few ways to celebrate your progress:

- Set specific goals and reward yourself when you achieve them

- Reflect on how far you’ve come and acknowledge your accomplishments

- Share your achievements with supportive individuals in your life

Seeking Professional Advice When Needed

Choosing A Financial Planner

When selecting a financial planner, it’s crucial to consider their qualifications, experience, and expertise. Look for a certified financial planner (CFP) who adheres to a fiduciary standard, putting your best interests first. Ensure they have a deep understanding of investment strategies and retirement planning.

When To Consult A Professional

Consult a professional financial advisor when facing complex financial decisions such as estate planning, tax optimization, or business succession. Additionally, seek their guidance during major life events like marriage, divorce, or the birth of a child.

Credit: www.lowewealthadvisors.com

Frequently Asked Questions

How Do I Create A Financial Freedom Plan?

To create a financial freedom plan, start by setting clear goals and determining your current financial situation. Next, create a budget and cut unnecessary expenses. Increase income by finding ways to earn more money. Pay off debt and save for emergencies and retirement.

Regularly review and adjust your plan to stay on track.

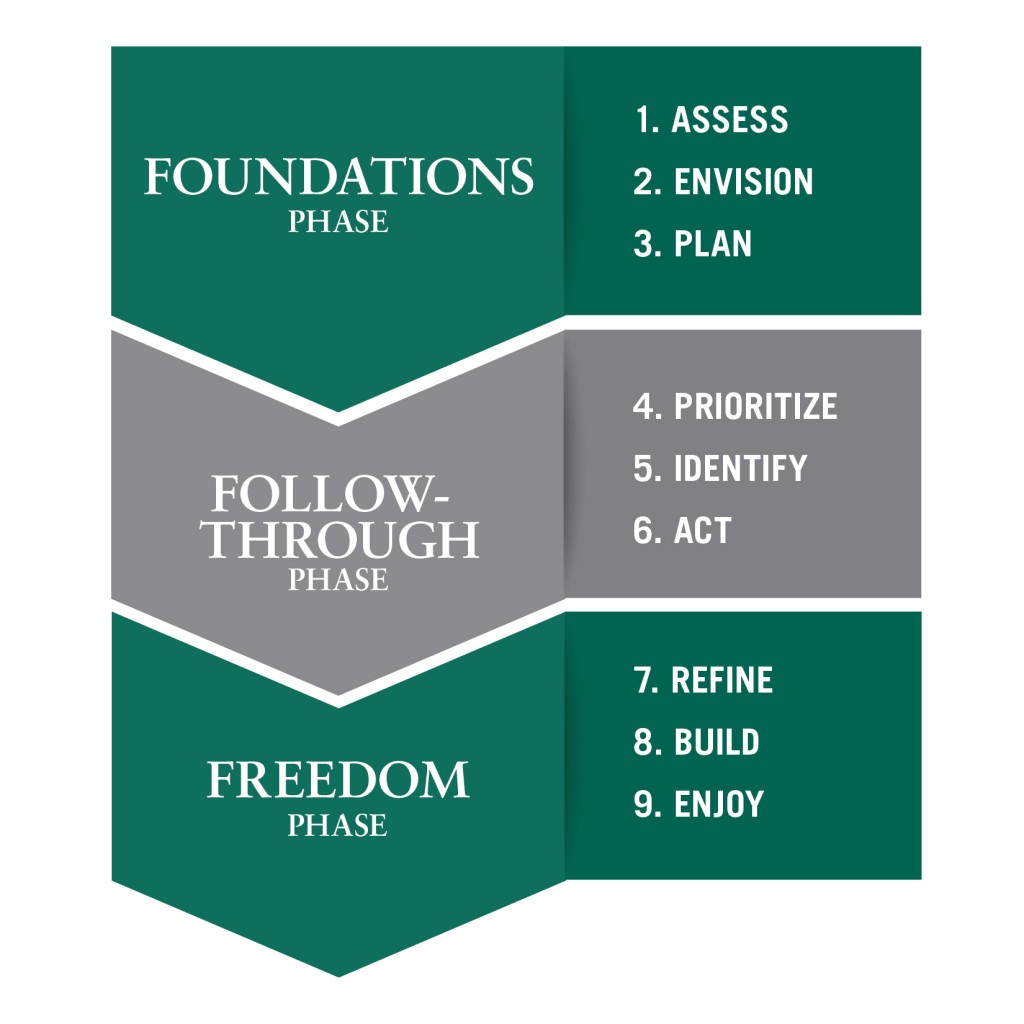

What Are The 7 Steps To Financial Freedom?

The 7 steps to financial freedom include setting financial goals, creating a budget, paying off debt, saving for emergencies, investing for the future, diversifying income streams, and continually educating oneself about personal finance. These steps help individuals achieve financial stability and independence.

What’s The 50/30/20 Rule And How Does It Work?

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. It helps you prioritize your spending and save for the future while still enjoying discretionary expenses.

Stick to this rule to maintain a balanced financial plan.

What Are Effective Methods For Maintaining Financial Freedom?

To maintain financial freedom, it’s important to create a budget, track spending, save money, avoid debt, and invest wisely. These methods require discipline and consistency, but can help individuals achieve long-term financial stability and independence.

Conclusion

To sum up, creating a financial freedom plan can be a challenging task, but it is essential for achieving financial stability and security. By following the steps outlined in this post, you can create a plan that works for you and your unique financial situation.

Remember to set realistic goals, track your progress, and be willing to make adjustments as needed. With determination and discipline, you can take control of your finances and work towards a brighter financial future.