Private equity and public markets offer distinct advantages depending on individual preferences and investment goals. In private equity, investors have the opportunity to invest directly in private companies, providing the potential for higher returns but with greater risk and illiquidity.

On the other hand, public markets provide access to a wide range of publicly traded securities, offering liquidity and diversification, albeit with potentially lower returns. Deciding which option is right for you requires careful consideration of factors such as risk tolerance, investment horizon, and desired level of involvement.

Understanding the unique characteristics and trade-offs of private equity and public markets is crucial in making an informed decision.

Credit: www.preqin.com

Introduction To Investment Spheres

When it comes to investing, understanding the different spheres of investment is crucial. Private equity and public markets are two major spheres that investors can explore. Both have their own unique characteristics and considerations and choosing between them requires a clear understanding of their basics.

Private Equity Basics

Private equity involves investing in companies that are not publicly traded on stock exchanges. Instead of buying shares of a company through the public markets, private equity investors typically acquire a stake in a company through direct investment. These investments are often made in the form of venture capital, growth capital, or buyouts, with the goal of providing capital to help the company grow and ultimately generate a return on investment.

Public Markets Explained

Public markets, on the other hand, involve buying and selling shares of publicly traded companies on stock exchanges. When investors buy shares of a company’s stock, they are essentially buying a portion of ownership in that company. Public markets offer a level of liquidity and transparency that is not always present in private equity investments, as the value of publicly traded stocks is determined by the supply and demand dynamics of the market.

Historical Performance Comparison

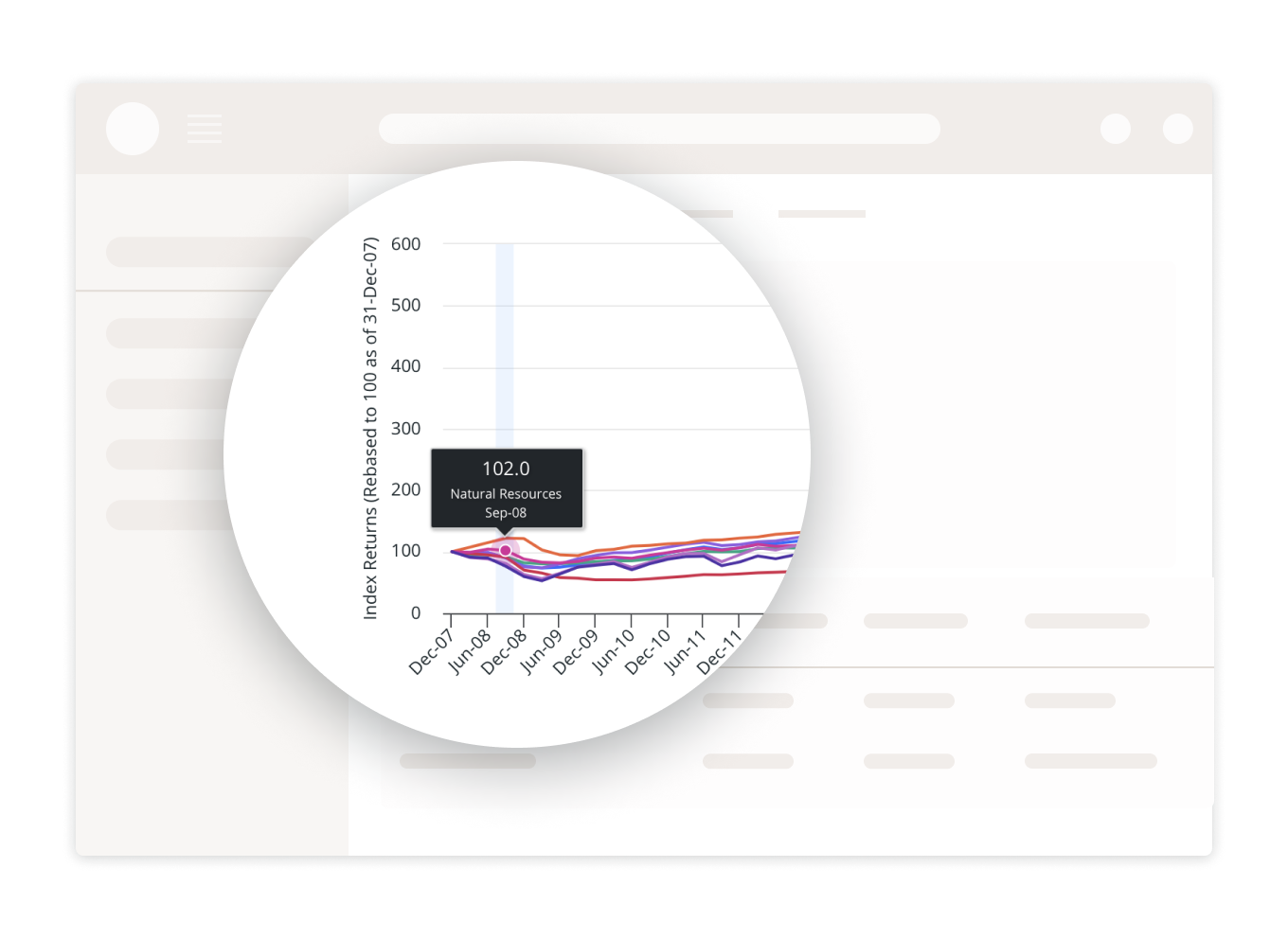

When deciding between private equity and public markets as investment options, it’s crucial to consider their historical performance. Understanding how these two types of investments have fared over time can help you make an informed decision about which is right for you.

Trends In Private Equity

Private equity has gained significant traction in recent years, with more investors recognizing its potential for high returns. In fact, according to industry reports, private equity has consistently outperformed public markets over the long term.

One key advantage of private equity is its ability to generate alpha, which refers to returns that exceed the overall market performance. This is often attributed to the unique characteristics of private equity investments, such as longer holding periods and the ability to actively manage the underlying assets.

Private equity investments also benefit from their focus on specific industries or sectors, allowing for targeted strategies and specialized knowledge. This can lead to better risk management and higher returns compared to public market investments, which are subject to broader market trends.

Public Market Indices Over Time

Public market indices, on the other hand, provide investors with exposure to a diverse range of companies through stocks and bonds. Over time, these indices have shown consistent growth, although with fluctuations influenced by various factors such as economic conditions, geopolitical events, and market sentiment.

One key advantage of public markets is their liquidity, allowing investors to buy and sell securities quickly and easily. This liquidity provides flexibility and the ability to adjust investment portfolios in response to changing market conditions.

Public market indices, such as the S&P 500 or the Dow Jones Industrial Average, are often used as benchmarks to assess the performance of investments. These indices reflect the overall performance of a broad range of publicly traded companies and are widely tracked by investors.

It’s important to note that while public markets have historically shown steady growth, they may not always provide the same level of returns as private equity investments. The volatility and short-term fluctuations in public markets can impact investment returns, making them more suitable for investors with a higher risk tolerance.

Ultimately, the choice between private equity and public markets depends on your investment goals, risk appetite, and time horizon. Understanding the historical performance of these investment options can help you make a more informed decision and tailor your portfolio to suit your specific needs.

Accessibility For Investors

Navigating between private equity and public markets is crucial for investors seeking the right fit. Understanding the accessibility and risk profiles of each option is key. Private equity offers higher potential returns but with less liquidity, while public markets provide easier access but with greater market volatility.

Entry Barriers In Private Equity

Private equity investments are known for their high entry barriers, making them accessible only to high-net-worth individuals and institutional investors. The minimum investment amounts in private equity can be substantial, ranging from hundreds of thousands to millions of dollars. This can make it difficult for average investors to participate in private equity deals. Additionally, private equity investments are typically illiquid, meaning they cannot be easily bought or sold on the open market.

Ease Of Access To Public Markets

In contrast, public markets are much more accessible to investors of all sizes. Anyone with a brokerage account can buy and sell stocks, bonds, and other securities on public exchanges. Public markets also offer a greater degree of liquidity, as securities can be bought and sold quickly and easily. This makes it easier for investors to adjust their portfolio holdings as market conditions change.

When it comes to accessibility for investors, public markets have a clear advantage over private equity. However, it’s important to note that private equity investments can offer unique opportunities and potentially higher returns for those who have the means to invest in them. For those who can’t meet the high entry barriers of private equity, public markets provide an attractive alternative with greater accessibility and liquidity.

Risk And Return Profiles

Private Equity and Public Markets have different risk and return profiles. Private Equity investments offer higher returns but with higher risk and longer holding periods. Public Markets, on the other hand, offer lower returns but with lower risk and higher liquidity.

Choosing between the two depends on an investor’s risk appetite, investment horizon, and financial goals.

Assessing Risk In Private Equity

Private equity investments are often considered high-risk, high-reward opportunities. Unlike public markets, private equity investments are not traded on stock exchanges and are not subject to the same regulations. Instead, investors typically make long-term commitments to private equity funds, which use the capital to acquire or invest in private companies. These investments can be risky because the underlying companies may be unproven, have limited financial data, or face significant market or regulatory hurdles. However, private equity investments may also offer higher returns than public markets, making them attractive to investors willing to take on more risk.

Understanding Public Market Volatility

Public markets, on the other hand, are subject to volatility due to a variety of factors, including economic conditions, geopolitical events, and investor sentiment. This volatility can lead to significant fluctuations in stock prices, which can affect investor returns. However, public markets offer greater liquidity than private equity investments, as stocks and other securities can be bought and sold quickly. Additionally, public markets are subject to greater regulation, which can provide investors with greater transparency and confidence in their investments.

When deciding between private equity and public markets, it’s important to consider the risk and return profiles of each. Private equity investments may offer higher returns but are also subject to greater risk, while public markets offer greater liquidity and regulatory oversight but are subject to volatility. Ultimately, the right choice depends on your investment goals and risk tolerance.

Liquidity Considerations

When deciding between private equity and public markets, liquidity is a crucial factor to consider.

The Illiquidity Of Private Investments

Private investments are characterized by their lack of liquidity.

Investors have limited ability to sell their stake quickly.

Trading Flexibility In Public Markets

Public markets offer greater trading flexibility.

Investors can buy and sell shares easily.

Impact Of Market Cycles

Market cycles have a significant impact on investment decisions, influencing the performance of both private equity and public markets. Understanding how these cycles affect each type of investment is crucial for making informed choices.

Private Equity In Economic Downturns

During economic downturns, private equity can face challenges due to reduced access to financing and declining valuations of portfolio companies. However, private equity firms often have the flexibility to support their portfolio companies through tough times, implementing strategic changes to drive long-term value.

Public Markets And Recessionary Pressures

In public markets, recessionary pressures can lead to heightened volatility and downward pressure on stock prices. Investors may face liquidity challenges, and market uncertainty can result in rapid swings in stock prices. However, public markets also offer the potential for quick exits and the ability to diversify investments across a wide range of assets.

Role Of Diversification

Diversification is essential when considering private equity vs. public markets. While private equity offers the potential for higher returns, it is also a riskier option. Public markets, on the other hand, offer greater liquidity and a more diverse range of investment options.

It ultimately depends on your risk tolerance and investment goals.

Portfolio Diversification With Private Equity

Diversification in private equity involves investing in various companies across industries. This reduces risk by spreading capital across different sectors. Investors can gain exposure to growth opportunities not available in public markets.

Public Market Instruments For Diversification

Public markets offer diversification through stocks, bonds, and ETFs. These provide access to different asset classes and sectors. Investors can mitigate risk by allocating funds across a range of securities.

Regulatory Environment

In the private equity vs. public markets debate, understanding the regulatory environment is crucial. Both options have their pros and cons, but it ultimately depends on your goals, risk tolerance, and investment strategy. Make sure to consider the regulatory framework surrounding each before making a decision.

Private Equity Compliance Challenges

The regulatory environment of private equity is complex and dynamic. Compliance is essential for success in this sector. Private equity firms must navigate stringent regulations to protect investors and maintain transparency.

Regulation Of Public Securities

Public markets are subject to strict regulations to ensure fair trading and investor protection. Regulations govern disclosure, trading practices, and market manipulation. Compliance is crucial for maintaining market integrity and investor confidence.

Case Studies: Successes And Failures

Explore the contrasting outcomes of private equity and public markets through case studies. Gain insights into the successes and failures of each, guiding your decision on the right investment path for you.

Triumphs In Private Equity

Public Market Investment Blunders

Case Studies: Successes and Failures

Private equity success stories showcase remarkable growth and profitability.

One such example is Warburg Pincus, which invested in Bausch + Lomb and saw exceptional returns.

In contrast, J.Crew struggled after being acquired by private equity firms.

Public markets have seen blunders like Enron and Lehman Brothers.

These failures highlight the risks associated with public market investments.

When considering private equity vs. public markets, learning from these case studies is crucial.

Future Outlook

Considering the future outlook, deciding between private equity and public markets depends on your investment goals and risk tolerance. Private equity offers long-term growth potential, while public markets provide liquidity and transparency. Understanding your financial objectives is crucial in determining the right investment path for you.

Predicting Private Market Trajectories

In the private equity landscape, the tech and healthcare sectors show promising growth potential. Emerging markets present lucrative investment opportunities. Diversifying into sustainable energy ventures can drive long-term profitability.

Public Market Trends To Watch

Public markets are influenced by geopolitical factors and economic indicators. Keep an eye on interest rate movements and inflation trends. E-commerce and digitalization trends are shaping consumer behavior. Tech stocks continue to be a focal point for investors.

Making The Right Choice

When it comes to investing, one of the most critical decisions you’ll face is choosing between private equity and public markets. Both options offer unique opportunities and challenges, making it essential to carefully consider which path aligns best with your investment goals and risk tolerance. Making the right choice requires strategic considerations for investors and thoughtful evaluation of the factors that differentiate these investment avenues.

Strategic Considerations For Investors

Before deciding between private equity and public markets, investors should assess their risk appetite, investment horizon, and the level of control they desire over their investments. Private equity investments typically involve longer holding periods and less liquidity compared to publicly traded securities. On the other hand, public markets offer easier access to diversification and liquidity but can be more susceptible to market volatility.

- Consider risk appetite and investment horizon

- Evaluate the level of control over investments

- Weigh liquidity and market volatility factors

Final Thoughts On Investment Selection

Ultimately, the decision between private equity and public markets should align with an investor’s specific financial objectives and risk tolerance. While private equity may offer the potential for higher returns and greater control over investments, it also entails longer investment horizons and limited liquidity. Conversely, public markets provide more immediate liquidity and easier diversification but may be subject to greater market volatility.

:max_bytes(150000):strip_icc()/Term-Definitions_Private-equity-673345d975244a9894e68d9b072a7969.png)

Credit: www.investopedia.com

:max_bytes(150000):strip_icc()/privateplacement.asp-finalv2-f8327aa785bd4295a67657a04765e829.png)

Credit: www.investopedia.com

Frequently Asked Questions

Why Is Private Equity Better Than Public Equity?

Private equity is better than public equity because it offers higher returns and greater control. Private equity investments are not subject to the volatility of the stock market and can be tailored to specific goals. Additionally, private equity allows for direct involvement in the management and strategic decisions of the invested companies, resulting in potentially higher profitability.

Is It Better To Invest In A Public Or Private Company?

It depends on your investment goals and risk tolerance. Public companies offer more liquidity and transparency, while private companies can provide higher growth potential. Consider factors like financial stability, market conditions, and your own investment strategy before deciding.

Do Private Markets Outperform Public Markets?

Private markets have the potential to outperform public markets due to their unique characteristics. They offer greater flexibility, longer investment horizons, and access to promising startups. However, it is important to note that performance can vary based on individual investments and market conditions.

Why Do People Choose Private Equity?

Private equity is chosen by people for its potential for high returns and diversification. It allows investors to participate in the growth of companies, offers access to unique investment opportunities, and provides long-term capital appreciation. Additionally, private equity allows for active involvement in decision-making and can offer attractive tax benefits.

Conclusion

Deciding between private equity and public markets depends on your individual financial goals, risk tolerance, and investment timeline. Private equity offers the potential for high returns but requires a longer-term commitment and higher risk. Public markets provide liquidity and diversification, making them more suitable for shorter-term investors.

Ultimately, it’s crucial to carefully evaluate your options and seek professional advice to determine which investment avenue aligns best with your objectives and circumstances. Choose wisely, and embark on a journey towards financial success.